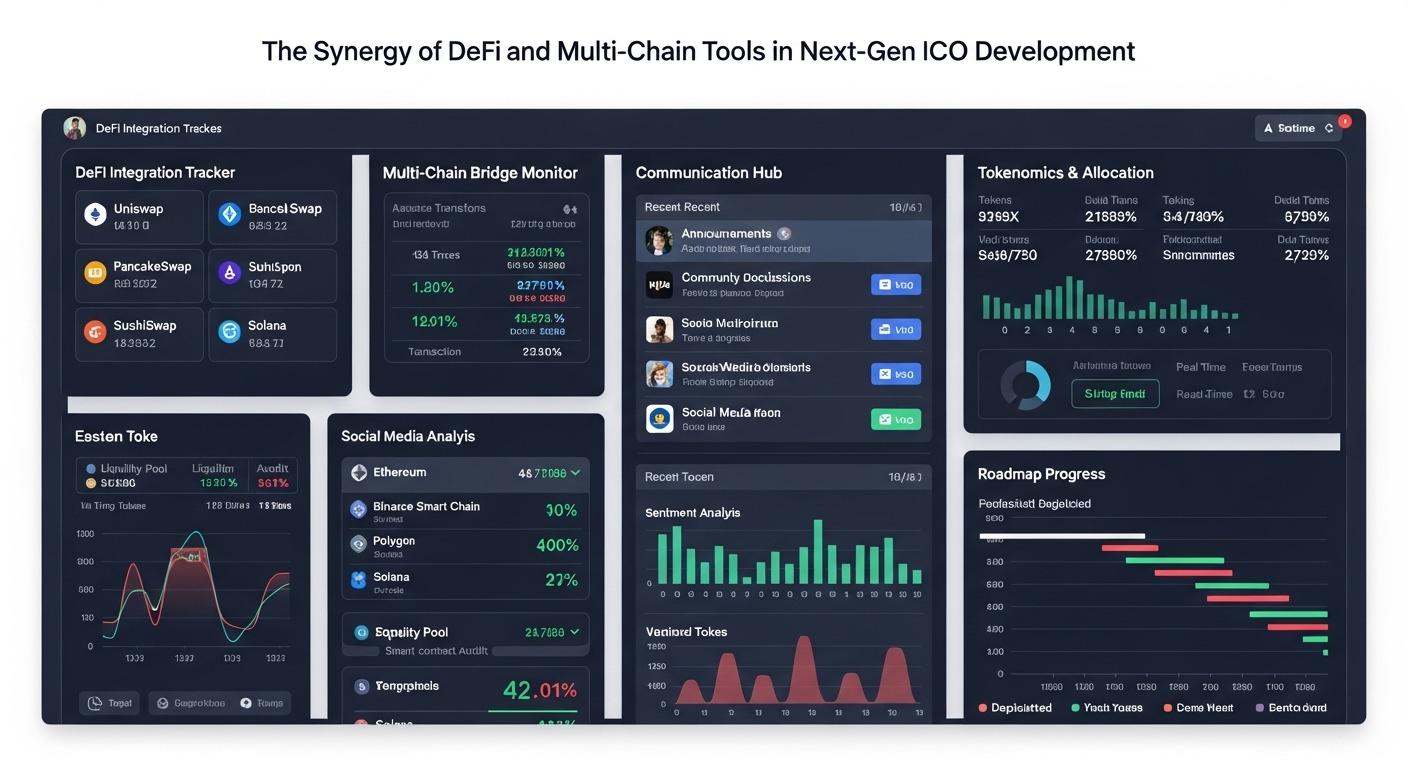

The Synergy of DeFi and Multi-Chain Tools in Next-Gen ICO Development

Introduction

The blockchain industry is evolving faster than ever. Traditional fundraising models are being replaced by smarter, decentralized methods. Among the most impactful innovations are DeFi (Decentralized Finance) and multi-chain tools, which are now at the heart of next-generation ICO development.

These two technologies are transforming how startups raise funds and how investors participate in token sales. With the right ico development services and ico development solutions, projects can now achieve global reach, improved transparency, and stronger liquidity — all at once.

Let’s explore how the synergy between DeFi and multi-chain tools is shaping the future of ICOs.

Understanding DeFi in ICO Development

DeFi stands for Decentralized Finance a blockchain-based financial system that removes intermediaries like banks and exchanges.

In ICO development, DeFi tools make fundraising faster, safer, and more transparent.

Key Features of DeFi in ICOs:

-

Smart contracts handle token sales automatically.

-

Staking and yield farming allow investors to earn rewards.

-

Liquidity pools help stabilize token prices after launch.

-

DAO governance gives token holders a say in project decisions.

DeFi gives both investors and founders full control of their assets and decisions, reducing the need for centralized platforms.

Understanding Multi-Chain Tools

In the early days, most ICOs launched on a single blockchain, usually Ethereum. While that worked well, it limited growth and accessibility.

Multi-chain tools now allow projects to operate across multiple blockchains at the same time such as Ethereum, Binance Smart Chain, Polygon, or Avalanche.

Benefits of Multi-Chain Support:

-

Global Accessibility: Reach more investors from different ecosystems.

-

Lower Fees: Choose chains with lower gas costs for transactions.

-

Faster Transactions: Some networks offer near-instant transfers.

-

Cross-Chain Trading: Tokens can move easily between chains.

By adopting multi-chain technology through an ico software development company, projects can maximize visibility and inclusivity while reducing technical barriers.

The Power of Combining DeFi and Multi-Chain Tools

When DeFi and multi-chain systems work together, they create a next-generation ICO experience that’s secure, efficient, and scalable.

Here’s what makes their combination powerful:

-

DeFi adds automation and transparency.

-

Multi-chain expands access and liquidity.

-

Together, they create borderless and trust-based fundraising ecosystems.

This synergy helps startups build credibility and investors gain confidence in project operations.

How DeFi and Multi-Chain Integration Work in ICO Development

Let’s break down how these systems collaborate throughout the ICO process.

1. Smart Contract Automation

-

Smart contracts manage every stage of the token sale, from investor registration to fund allocation.

-

Multi-chain compatibility allows these contracts to function on multiple blockchains.

-

The result: global investors can participate easily, using their preferred networks.

2. Cross-Chain Token Distribution

-

Tokens can be issued and distributed across multiple chains simultaneously.

-

Investors receive tokens that are compatible with their chosen blockchain.

-

This enhances participation and reduces friction in fundraising.

3. DeFi-Driven Liquidity Pools

-

After the ICO, tokens can be added to decentralized liquidity pools on various chains.

-

These pools ensure that tokens remain tradable and stable.

-

Liquidity farming rewards encourage long-term investor engagement.

4. Staking and Yield Programs

-

Investors can stake their tokens to earn rewards or governance rights.

-

This feature promotes loyalty and reduces token dumping after the ICO.

-

A professional ico development agency can design flexible staking systems across multiple chains.

5. DAO-Based Governance

-

Through DeFi protocols, token holders can vote on project proposals.

-

Multi-chain setups allow these votes to be synchronized across networks.

-

This ensures fairness, transparency, and active community participation.

Benefits for Investors

The combination of DeFi and multi-chain frameworks provides multiple advantages for investors.

Key Benefits:

-

Enhanced Security: Smart contracts protect funds from tampering.

-

Cross-Chain Accessibility: Investors can participate using their preferred blockchain.

-

Higher Liquidity: Tokens are tradable across multiple networks.

-

Earning Potential: Staking and liquidity mining generate passive income.

-

Transparency: DeFi dashboards show real-time data on funds and token distribution.

A trusted ico dashboard development company can design user interfaces that display all this data clearly, helping investors track their assets effortlessly.

Benefits for Founders

For project founders, DeFi and multi-chain integration streamline fundraising while improving credibility.

Advantages Include:

-

Broader Market Reach: Connect with investors from various blockchain communities.

-

Lower Costs: Choose cost-effective chains for token sales and transactions.

-

Faster Launch: Multi-chain frameworks simplify deployment.

-

Investor Confidence: Transparent, automated systems attract more participants.

-

Sustainable Growth: Liquidity and governance tools support long-term success.

By choosing expert ico software development services, startups can create reliable systems without sacrificing performance or security.

Real-World Use Cases of DeFi + Multi-Chain ICOs

Example 1: Multi-Chain Fundraising

A project launches its ICO on both Ethereum and Binance Smart Chain.

-

Ethereum offers visibility.

-

Binance Smart Chain provides low-cost transactions.

-

Investors can buy tokens on their preferred network, and both token supplies remain synchronized.

Example 2: Cross-Chain Staking

Investors stake tokens on one blockchain and receive rewards distributed across multiple chains.

-

Encourages long-term participation.

-

Expands token use beyond a single ecosystem.

Example 3: DAO-Governed Ecosystems

Token holders on various networks participate in joint voting sessions to guide project growth.

-

Promotes fairness and decentralization.

Each of these examples reflects the growing synergy between DeFi automation and multi-chain infrastructure in ICO development.

Challenges in Integrating DeFi and Multi-Chain Tools

Despite the many benefits, integration isn’t always simple.

Common Challenges:

-

Technical Complexity: Managing smart contracts across multiple chains requires expertise.

-

Security Risks: Cross-chain bridges can be vulnerable to attacks if not properly secured.

-

High Development Costs: Advanced integration requires experienced ico development company teams.

-

Interoperability Issues: Different blockchains have varying standards and protocols.

These challenges can be overcome by partnering with experienced developers who offer reliable ico development solutions and continuous technical support.

The Future of DeFi and Multi-Chain ICO Development

The collaboration between DeFi and multi-chain technology will only continue to grow.

Upcoming Trends:

-

Cross-Chain DeFi Platforms: Unified systems connecting multiple blockchains for token sales.

-

AI-Powered Fund Management: Smarter analysis and automated investor reporting.

-

DeFi Insurance Models: Protecting ICO participants from risks or smart contract failures.

-

Seamless Token Transfers: Real-time asset movement between chains with no manual bridging.

-

Enhanced Compliance Tools: On-chain KYC and AML verification for global regulation.

These advancements will make ICOs safer, faster, and more inclusive than ever before.

Steps to Build a DeFi and Multi-Chain Powered ICO

If you’re a founder planning to launch a modern ICO, here’s how you can use both DeFi and multi-chain tools effectively:

-

Partner with an experienced ico development company for technical setup.

-

Design secure smart contracts with cross-chain compatibility.

-

Integrate liquidity pools and staking mechanisms.

-

Develop a transparent dashboard for investor monitoring.

-

Set up governance models through DeFi protocols.

-

Test and audit contracts on all selected blockchains.

-

Launch your ICO with full documentation and community support.

This structured approach helps ensure smooth operations and lasting trust.

Conclusion

The future of ICO development lies in combining the power of DeFi and multi-chain tools. Together, they bring automation, global reach, and transparency the three pillars of successful blockchain fundraising.

Investors gain confidence through secure and open systems, while founders benefit from scalability and long-term sustainability.

With professional support from a reliable ico software development company or ico development agency, your project can unlock the full potential of next-generation fundraising.

DeFi and multi-chain synergy isn’t just a trend it’s the future of how the crypto world builds trust, value, and opportunity.

- Creative Multimedia

- Education & Innovation

- Business & Technology

- Sustainability & Ethics

- App & IT Development

- Community & Culture

- Thought Leadership

- Evento

- AI & Robotics

- Craft

- Ver Página

- Fitness

- Free Peck

- Jogo

- Tutorial

- Health

- Music

- Networking

- Outro

- Business

- Religion

- Shop

- Sport

- Wellbeing